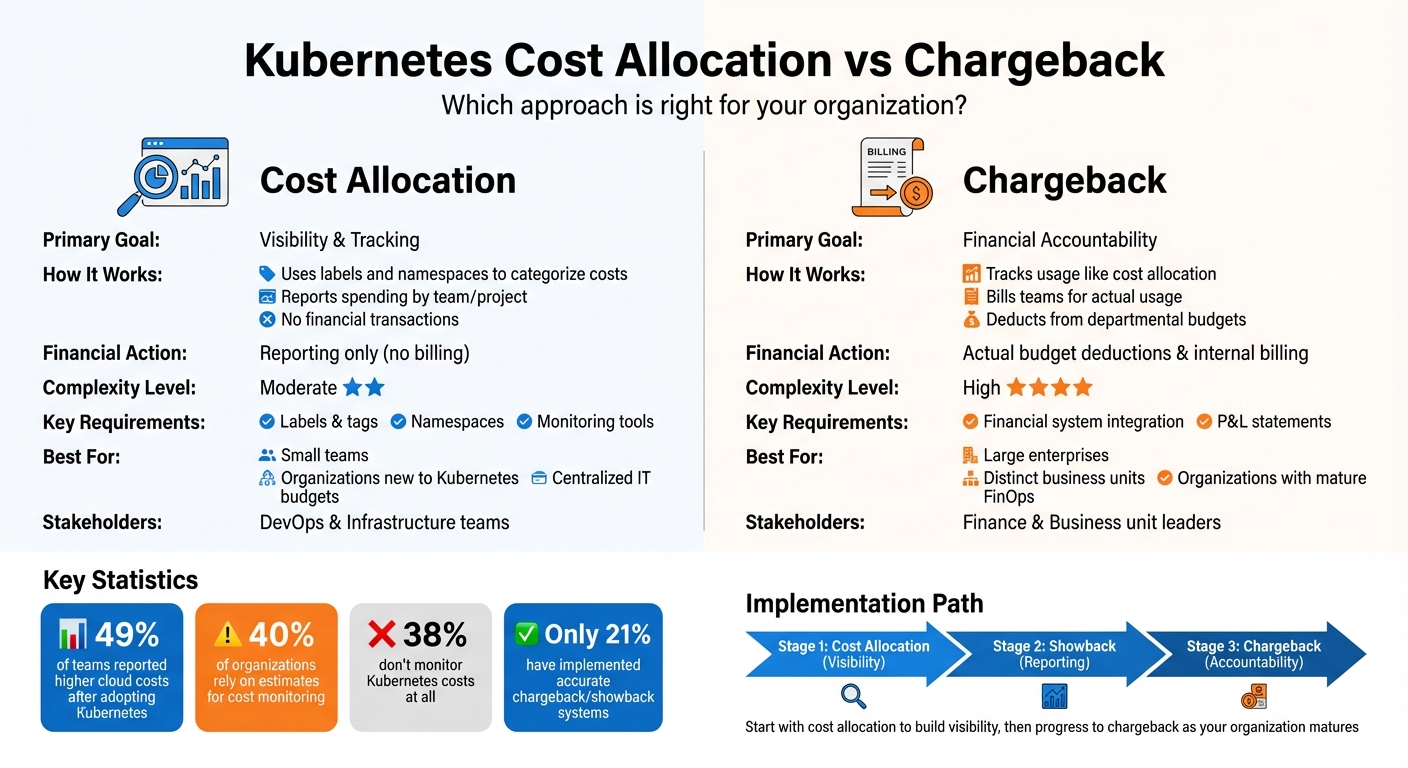

Kubernetes environments can make tracking cloud costs tricky, especially in shared, dynamic setups. UK businesses often struggle to pinpoint which teams or projects are driving expenses. Two strategies - cost allocation and chargeback - can help manage these costs effectively:

- Cost Allocation: Tracks and categorises expenses by team, project, or department using Kubernetes metadata like labels and namespaces. It focuses on visibility, helping teams understand their spending without assigning direct financial responsibility.

- Chargeback: Goes further by billing teams for their actual usage, holding them financially accountable. This method integrates with internal accounting systems, deducting costs from departmental budgets.

While cost allocation is simpler and ideal for organisations new to Kubernetes cost management, chargeback enforces stricter accountability, making it better suited for larger enterprises with distinct business units. Both approaches aim to reduce waste, improve resource usage, and provide better financial insights.

Quick Comparison

| Factor | Cost Allocation | Chargeback |

|---|---|---|

| Goal | Visibility and tracking | Financial accountability |

| Action | Reporting only | Budget deductions/internal billing |

| Complexity | Moderate | High |

| Best For | Small teams or beginners | Large enterprises |

Choosing the right approach depends on your organisation's size, structure, and financial maturity.

::: @figure  {Kubernetes Cost Allocation vs Chargeback: Key Differences and Use Cases}

:::

{Kubernetes Cost Allocation vs Chargeback: Key Differences and Use Cases}

:::

Webinar: Kubernetes Cost Allocation Done Right

What is Kubernetes Cost Allocation?

Kubernetes cost allocation is all about figuring out who’s using what when it comes to cloud resources. It involves breaking down your cloud costs and assigning them to specific teams, departments, or projects based on their actual usage [6]. Instead of seeing one big bill for your Kubernetes usage, cost allocation gives you a detailed view of which workloads are driving your expenses.

Think of it like moving from a single electricity meter for an entire office building to individual meters for each department. Without this level of detail, teams often treat shared Kubernetes resources as free

, which can lead to wasteful usage, unexpected budget overruns, and poor financial planning [11].

Traditional cloud billing usually charges at the compute level - you pay for entire nodes or virtual machines. Cost allocation, on the other hand, goes deeper, offering detailed insights that help you track cloud expenses more precisely [9]. This is especially useful in multi-tenant clusters, where several applications share the same physical infrastructure.

How Cost Allocation Works in Kubernetes

Kubernetes cost allocation uses the platform’s metadata to trace spending back to specific teams or projects. The two main tools for this are labels (key-value pairs like team: payments or env: production) and namespaces (virtual clusters that group related pods) [5]. Cloud providers such as AWS integrate these Kubernetes labels with billing tags. For instance, AWS allows up to 50 Kubernetes labels per pod to appear as cost allocation tags in their Cost and Usage Report (CUR), but these labels need to be activated at the management account level first [8].

Costs are divided based on resource consumption - this includes CPU, RAM, GPU, storage, and network egress [5]. For example, a GPU-heavy machine learning task will incur different costs compared to a storage-focused database application. Allocation can be done in two ways:

- Resource Requests: Charges are based on the capacity reserved for a pod, encouraging teams to reserve only what they need.

- Actual Usage: Costs reflect what the pod actually consumed, even though the organisation might still bear the cost of unused capacity [1].

In addition to direct resource costs, there are satellite costs

to consider. These are shared expenses, such as management nodes, load balancers, storage backups, and software licences that keep your cluster running smoothly [1]. Getting a clear picture of these costs is crucial for effective financial management, as highlighted in the next section.

Benefits of Cost Allocation

Cost allocation gives you a clearer understanding of your spending patterns, which can reveal inefficiencies. For instance, if one team’s resources are eating up a large chunk of your cluster capacity, it might spark discussions about optimising workloads or scheduling jobs during off-peak hours.

By addressing the misuse of shared resources, cost allocation encourages teams to fine-tune their resource requests and clean up unused deployments. This is supported by the 2023 CNCF FinOps survey, which found that 40% of organisations rely on estimates instead of actual data for Kubernetes cost monitoring, and 38% don’t monitor costs at all [4].

For businesses in the UK managing multiple projects or departments, cost allocation makes budget planning and forecasting far more accurate. It turns cloud spending from a confusing operational expense into something you can predict and control.

What is Kubernetes Chargeback?

Kubernetes chargeback takes cost visibility a step further by billing teams for the resources they actually use [2][6]. In this model, your IT department operates like an internal vendor, charging business units or application owners based on the specific resources their workloads consume [2]. Unlike simpler cost allocation methods, chargeback involves recovering costs through internal accounting processes like budget deductions or journal vouchers [6].

Chargeback is about an actual charging of incurred costs to those entities via an organisation's internal accounting processes, such as financial systems or journal vouchers.- AWS [6]

This method introduces real financial accountability. For instance, if a development team deploys a new application, the costs for CPU, RAM, storage, and network usage are directly deducted from their department's budget [12].

Chargeback represents the third stage of financial maturity in Kubernetes cost management. It begins with allocation, progresses to showback, and ultimately culminates in chargeback, which enforces budgetary discipline [2]. However, only 21% of organisations have successfully implemented a reliable chargeback or showback system [4].

How Chargeback Works in Kubernetes

Implementing chargeback in Kubernetes involves several key steps. First, workloads are organised using namespaces and labels, which help link pods and containers to specific teams or projects [5]. For example, you might assign a namespace like payments-team to group all applications managed by the payments department.

The next step is measuring resource usage. This includes tracking CPU, RAM, GPU, storage, and network bandwidth consumption [5]. For cloud-based Kubernetes clusters, you can leverage billing data from providers like AWS or Google Cloud (e.g., AWS Cost and Usage Reports, GKE cost allocation). On-premises clusters require a different approach, where costs for hardware, software licences, labour, and facilities (e.g., power and cooling) are amortised into an hourly rate, typically calculated over a 3–5 year hardware refresh cycle [5].

Shared resources, such as system namespaces, monitoring tools, or idle capacity, are allocated proportionally to ensure fairness [2]. The final step integrates the processed cost data into your organisation’s accounting system, generating internal invoices and deducting expenses directly from departmental budgets [6].

For chargeback to be effective, it must meet four key criteria: it should be accurate, timely, fair, and complete [2].

These processes align seamlessly with internal accounting systems, laying the groundwork for the financial advantages discussed below.

Benefits of Chargeback

Chargeback introduces direct financial accountability, encouraging teams to optimise their resource usage. When teams know they’ll be billed for what they request, they’re more likely to adjust workloads appropriately and eliminate waste [12]. This approach also addresses the tragedy of the commons

in multi-tenant environments, where resources perceived as free

often lead to over-provisioning and underutilisation [2].

In a chargeback model, IT (or the relevant infrastructure team) becomes a commercial supplier to a cost centre representing a business unit or an application owner.- Apptio/Kubecost [2]

Chargeback also supports better business decisions. By linking costs to specific projects or products, leadership can identify which applications deliver the best return on investment (ROI). This allows organisations to prioritise funding for revenue-generating initiatives while scaling back on less impactful ones [6]. Additionally, charging based on resource requests rather than actual usage motivates teams to make realistic estimates and avoid reserving resources they don’t need.

Many organisations start with a showback model - providing visibility without billing - to build trust in the data before transitioning to full chargeback. It’s also essential to include related expenses, such as cloud storage, load balancers, and licensing fees, to ensure a comprehensive financial overview [2].

Key Differences Between Cost Allocation and Chargeback

While both cost allocation and chargeback aim to manage Kubernetes spending, their purposes and approaches are quite distinct. Cost allocation leans heavily on the technical side, focusing on visibility. It tracks and maps resource usage to specific teams or projects by using labels and namespaces. Chargeback, however, takes things a step further by incorporating financial processes - deducting costs directly from departmental budgets through internal accounting systems [2].

Cost allocation prioritises technical precision, relying on tagging, monitoring, and metering. Chargeback, on the other hand, requires deeper organisational and financial integration. Many organisations start with cost allocation to gain visibility, move to showback reporting for transparency, and eventually adopt chargeback once they trust the data's accuracy.

The financial implications of these models differ significantly. Cost allocation provides teams with spending insights, but payments are still managed centrally by IT or Finance. Chargeback shifts this dynamic, treating the IT department more like a service provider. Teams then face direct budget deductions based on their resource usage. This transition from simple awareness to financial accountability often changes how teams approach resource planning and requests.

Comparison Table: Cost Allocation vs Chargeback

| Factor | Cost Allocation | Chargeback |

|---|---|---|

| Primary Goal | Visibility and resource tracking | Cost recovery and financial accountability |

| Financial Action | None (reporting only) | Actual budget deduction or internal billing |

| Complexity | Moderate (technical focus) | High (organisational and financial focus) |

| Key Requirements | Labels, namespaces, and tags | Financial systems and P&L integration |

| Stakeholders | DevOps and infrastructure teams | Finance and business unit leaders |

| User Impact | Awareness of spending patterns | Responsibility for profit and loss |

| Shared Costs | Identified but not necessarily split | Divided based on agreed fairness rules |

| Implementation | Easier; less cultural friction | More challenging; requires high trust in data |

| Best Use Case | Smaller teams or organisations new to Kubernetes | Large enterprises with distinct business units |

When to Use Cost Allocation Over Chargeback

Cost allocation provides a straightforward way to track cloud spending without the need for complicated internal billing systems. By breaking down costs by tenant or project, it offers clarity when central teams manage all cloud expenses. This method avoids the hassle of integrating with financial systems or creating journal vouchers, making it an excellent starting point for gaining visibility into cloud expenses. This visibility is critical for making informed decisions.

Interestingly, only 21% of organisations have successfully implemented an accurate chargeback or showback system, while 38% lack any Kubernetes cost monitoring altogether [4]. AWS explains the distinction clearly: Showback is about presentation, calculation, and reporting of charges incurred by a specific entity... Chargeback is about an actual charging of incurred costs to those entities via an organization's internal accounting processes

[6]. Here, we’ll focus on why cost allocation might be the better choice, especially for organisations just starting to manage cloud costs.

Cost allocation is especially useful when dealing with shared expenses. For instance, Kubernetes resources like the kube-system namespace, idle capacity, or cluster-wide observability tools are notoriously hard to divide fairly. Simply reporting these shared costs - without trying to bill individual teams - helps maintain trust among stakeholders and avoids unnecessary disputes.

For organisations running dynamic or short-lived workloads, cost allocation offers immediate insights that engineering teams can use to optimise their operations. Real-time reporting on these ephemeral workloads allows for quicker adjustments compared to the slower financial reconciliations required by chargeback systems. This is especially helpful when managing Kubernetes costs, a challenge highlighted by the fact that 49% of teams reported higher cloud costs after adopting Kubernetes [4].

To make cost allocation effective, start by implementing a strong tagging and labelling strategy. Use tags like Cost Centre

, Environment

, or Application ID

before deploying resources, as tags cannot be added retroactively [3]. Additionally, namespaces can help define boundaries for team-specific cost attribution. Automating tag enforcement with cloud-native policies ensures consistency and accuracy [3][1]. By laying this groundwork, organisations not only improve cost visibility but also set the stage for transitioning to chargeback if stricter financial accountability becomes necessary. A solid tagging strategy ensures you’re prepared for tighter cost controls when the time comes.

Need help optimizing your cloud costs?

Get expert advice on how to reduce your cloud expenses without sacrificing performance.

When to Use Chargeback Over Cost Allocation

Chargeback becomes a key strategy when organisations need more than just cost visibility - they need to enforce financial accountability. Unlike cost allocation, chargeback directly deducts expenses from team budgets using internal accounting systems, effectively turning IT into an internal service provider. As AWS puts it:

Chargeback is about an actual charging of incurred costs to those entities via an organisation's internal accounting processes, such as financial systems or journal vouchers[6].

This method addresses the issue of over-provisioning, particularly in shared environments. When teams view shared Kubernetes infrastructure as unlimited or free, they often over-provision resources. By holding each business unit accountable for its own profit and loss statement, chargeback ensures teams purchase

infrastructure from their budgets. This creates a strong incentive to optimise workloads and cut down on waste [2].

The financial impact becomes even more pronounced when charges are based on reserved capacity rather than actual usage. This discourages teams from reserving excessive capacity buffers that often remain unused, contributing to cluster inefficiency. Harrison Sweeney, a Data Engineer at Google Cloud, explains:

Designing a chargeback system for a large organisation is ultimately about designing incentives for teams to proactively monitor their cloud spend[12].

By requiring teams to pay for reserved capacity, organisations encourage tighter, more precise resource allocation.

Chargeback is particularly suitable for large enterprises, especially those with complex, multi-team environments where DevOps teams make independent provisioning decisions. It also meets the needs of senior management by enforcing strict budget controls. Automated alerts can notify teams when their daily spend exceeds thresholds, allowing immediate adjustments rather than relying on delayed reconciliations [2][5]. However, implementing chargeback is a sophisticated process that requires collaboration with finance departments to integrate systems capable of generating profit and loss statements. This makes it a more advanced approach compared to basic cost allocation [2].

For organisations new to chargeback, starting with a transitional showback stage can ease the shift from visibility to accountability. Showback reports, which display costs without directly charging teams, help build trust in the accuracy of data. They also give teams time to adjust their behaviour before financial accountability takes effect. This gradual approach helps organisations move from simple visibility to genuine accountability while maintaining support from engineering teams [2].

Implementing Cost Allocation and Chargeback in Kubernetes

When it comes to cost allocation and chargeback in Kubernetes, a practical approach is essential. Kubernetes itself doesn't offer built-in tools for cost tracking, which can make understanding expenses in multi-tenant clusters a challenge. As James Walker from Rafay puts it:

Kubernetes doesn't include any tooling for tracking costs associated with individual workloads. This makes it hard to understand where costs are being incurred, particularly for busy multi-tenant clusters[4].

To address this, collaboration between Finance, Engineering, and Business teams is vital. Early on, these stakeholders should agree on a consistent tagging strategy. Tags like cost-center, application, and environment are the foundation for accurate cost attribution [3]. For those using AWS, remember that label limits mean critical cost-related labels should be named to appear early alphabetically to avoid being truncated.

Selecting the right tools is another key step. Kubecost and OpenCost are popular options, offering real-time cost allocation by namespace, deployment, and label [13][4]. Cloud-specific solutions also exist, such as AWS EKS Split Cost Allocation, which maps Kubernetes labels to cost tags in AWS Cost and Usage Reports, and GKE Cost Allocation, which exports detailed spending data to BigQuery [8][10]. Be aware, though, that GKE cost data might take up to three days to appear after activation, and using BigQuery will incur additional storage and querying costs [10]. These tools lay the groundwork for implementing best practices tailored to your environment.

Best Practices for Implementing Cost Allocation

Once the tools are in place, a clear strategy for organising resources and optimising workloads is essential. Start by structuring resources with AWS Organisations, Azure Resource Groups, or GCP Folders before applying detailed labels [3]. This creates a logical structure that simplifies reporting. In multi-tenant clusters, namespaces often serve as the primary cost centre boundary, making it easier to aggregate costs compared to tracking individual pod labels [4][5].

Right-sizing workloads is another critical step. Kubernetes typically bases cost allocation on resource requests rather than actual usage. For instance, if a deployment consistently uses only 60% of its requested resources, lowering the request can reduce allocated costs without affecting performance [4][10]. It's also important to account for shared costs and system overhead - the resources consumed by Kubernetes itself - to ensure the total cluster bill is fully accounted for [10]. Setting resource quotas at the namespace level can help prevent tenants in shared clusters from exceeding their budgets [4].

Automation can significantly minimise manual errors. For example, you can use Helm charts to install Kubecost with Prometheus pre-configured [13][5]. Automating tagging through inheritance - where tags are applied based on the parent namespace or cluster - removes the need for manual input [11]. Budget alerts are another useful tool, helping to flag spending spikes compared to historical averages and avoiding end-of-month surprises

[5].

Best Practices for Implementing Chargeback

While cost allocation focuses on tracking, chargeback ensures financial accountability. To implement chargeback effectively, integrate finance and ERP systems to enable direct budget deductions and generate profit and loss statements [2]. Many organisations start with showback, where costs are reported without actual billing. This transitional step helps build trust in the data and gives teams time to adjust their behaviour [2].

Establishing clear billing policies is crucial. Decide how costs will be calculated - will teams be billed for reserved capacity or actual usage? How will idle resources, such as unused provisioned capacity, be handled? These idle costs can either be distributed proportionally or assigned to a central IT overhead budget [2]. Don't overlook network egress fees, as these can be substantial and are often missed in basic compute-only tracking [4].

Regular monitoring is essential to maintain accuracy. Teams should frequently review the gap between resource requests and actual usage. For example, GKE cost allocation is based on resource requests, so over-provisioning can lead to inflated costs, even if the resources aren't fully utilised [10][4]. Automated alerts can notify teams when their daily spend exceeds thresholds, enabling quick adjustments rather than waiting for delayed reconciliations [2][5]. However, be cautious with cost-cutting measures like reducing resource limits, as overly aggressive reductions could lead to performance issues or Out of Memory (OOM) events [5].

For on-premises setups, cost calculations involve amortising expenses like hardware, software licences, datacentre space, power, cooling, and labour over time. For instance, a node costing £7,500 over five years breaks down to approximately £0.17 per hour [5]. This contrasts with public cloud options like AWS EKS, which charges £0.10 per hour for the control plane, plus additional costs for EC2 and EBS [5].

This combination of tools, strategies, and best practices ensures a robust approach to managing Kubernetes costs effectively.

Benefits and Challenges in Kubernetes Environments

Benefits of Cost Allocation and Chargeback

Cost allocation and chargeback bring a much-needed level of accountability to cloud spending. Without these systems in place, teams often treat shared cloud resources as if they’re bottomless and free, leading to unnecessary overuse and waste [2]. However, when departments are made aware of their actual spending, behaviours tend to shift quickly.

For leadership, financial transparency offers a clear view of IT cash flow, enabling better investment decisions and ensuring compliance with regulations. In the UK, this transparency can also help businesses identify R&D expenses that may qualify for tax relief [6][11]. Additionally, tracking ROI by specific projects or business units allows organisations to make smarter funding decisions.

Operationally, cost visibility uncovers forgotten deployments and unused resources - two common culprits behind unexpected bills in multi-tenant clusters. By analysing historical spending patterns and real-time usage data, organisations can improve budget forecasting and avoid those end-of-month surprises [1]. Together, these benefits lay the groundwork for better Kubernetes cost management in UK enterprises.

That said, managing costs in Kubernetes environments isn’t without its difficulties.

Challenges and How to Overcome Them

The dynamic nature of Kubernetes presents unique hurdles. Resources in these environments often exist for only a few minutes due to auto-scaling, making it difficult to track their origins or predict whether the associated costs will recur [4]. Multi-tenant clusters add another layer of complexity, as shared infrastructure like load balancers or the kube-system

overhead cannot be directly attributed to a single team. Instead, these costs must be divided proportionally [4].

Another issue is Kubernetes' lack of built-in cost tracking tools. A staggering 40% of organisations rely on rough estimates for cost monitoring, while 38% have no system in place at all [4]. Manual tagging errors further compromise cost accuracy, and satellite expenses - such as network egress charges, storage backups, and software licensing - are frequently overlooked [2].

To tackle these challenges, automation and phased strategies are key. Starting with showback reporting, where costs are calculated and shared without actual billing, can help build trust and prepare teams for full chargeback implementation [2]. Automating tagging through inheritance - applying tags based on parent namespaces or clusters - reduces human error and ensures better coverage [11]. Setting resource quotas for namespaces can prevent runaway costs from a single team [4]. Finally, monitoring cluster health alongside spending ensures cost-saving measures don’t lead to performance issues [5].

A real-world example of overcoming these challenges comes from LiveRamp. In 2020, the company moved its on-premises services to Google Cloud Platform and initially faced significant budget overruns. Developers had not yet fully grasped their financial responsibilities in the cloud. Sasha Kipervarg and the Global Cloud Operations team addressed this by enforcing namespacing for large clusters and refining tagging policies. These FinOps-driven actions helped LiveRamp optimise cloud costs and improve cost allocation accuracy across its engineering teams [1].

Conclusion

Deciding between cost allocation and chargeback largely hinges on your organisation's structure and level of maturity. Cost allocation lays the groundwork by categorising expenses using tags and namespaces, while showback takes it a step further by reporting costs to teams without actual financial transactions. This approach builds awareness and trust in the data. Chargeback, on the other hand, goes deeper by treating internal teams as customers, deducting costs from their budgets to ensure direct accountability for spending [2].

Recent data highlights the importance of making the right choice. For instance, 49% of teams experienced increased cloud costs after adopting Kubernetes, yet only 21% have managed to implement accurate chargeback or showback systems [4]. This gap presents a real opportunity for UK organisations to take control of their cloud expenses. If your business is among the 40% relying on rough estimates or the 38% without any monitoring systems, starting with basic cost allocation is a practical first step before moving on to more advanced methods [4].

For larger organisations where business units operate as independent profit-and-loss centres, chargeback offers a powerful incentive for teams to optimise their workloads. As Harrison Sweeney, Data Engineer at Google Cloud, explains:

Designing a chargeback system for a large organisation is ultimately about designing incentives for teams to proactively monitor their cloud spend[12].

In contrast, smaller businesses or those with centralised IT budgets may find that showback achieves similar behavioural shifts without the extra complexity of full financial integration.

A hybrid model often strikes the best balance: use direct allocation for workloads with clear ownership and proportional allocation for shared services like networking or security [12][7]. To ensure accurate billing data, it’s essential to establish mandatory tagging from the beginning, as retroactive tagging isn’t feasible [3]. Additionally, base chargebacks on resource requests rather than actual usage to encourage developers to request only what they need, reducing idle resources across clusters [12].

Whether you’re just starting your FinOps journey or fine-tuning an existing programme, the ultimate goal remains the same: fostering a culture where engineering teams actively manage costs, rather than treating cloud resources as limitless. For UK businesses navigating these challenges, Hokstad Consulting offers expertise in cloud cost engineering and DevOps transformation, helping organisations craft cost management strategies tailored to their unique infrastructure and goals.

FAQs

What are the main advantages of using cost allocation in Kubernetes?

Cost allocation in Kubernetes offers a transparent view of expenses, enabling organisations to grasp how resources are being used. By linking costs to particular teams, projects, or departments, it fosters responsibility and motivates smarter resource management.

This method also aids in budgeting and forecasting, helping businesses plan with greater precision and minimise waste. In essence, cost allocation ensures operational expenses are shared fairly and openly, enhancing financial management within Kubernetes setups.

How does chargeback enhance financial accountability in large organisations?

Chargeback helps ensure that every team takes financial responsibility for the Kubernetes resources they use by directly tying their consumption to internal billing. This approach logs costs in the organisation's financial system, providing a clear view of spending and motivating teams to handle their budgets more carefully.

By making expenses transparent and directly linked to usage, chargeback encourages better financial accountability across departments. This not only helps large organisations use resources more efficiently but also keeps their spending aligned with broader financial objectives.

When is it appropriate for a business to move from cost allocation to chargeback in Kubernetes?

The choice between cost allocation and chargeback hinges on your organisation's financial goals and level of operational maturity. Cost allocation works well for tracking expenses across teams or projects without directly assigning financial responsibility. On the other hand, chargeback is ideal when the aim is to hold teams accountable by billing them for the resources they use.

For organisations experiencing rapid growth, juggling intricate budgets, or aiming to encourage more mindful resource usage, chargeback could be a better fit. However, it’s important to carefully assess your operational objectives and ensure your teams are ready to adapt to the mindset shift that chargeback often brings.