Cloud costs are hard to predict, but UK businesses can save up to 30–50% by using What-If models. These AI-powered tools simulate future scenarios, enabling organisations to plan for traffic spikes, seasonal demand, or new services. Unlike static spreadsheets, What-If models analyse historical data and adjust for dynamic workloads, pricing changes, and multi-cloud complexities.

Key insights:

- 32% of cloud spending is wasted, with underused resources and overprovisioning being major culprits.

- Seasonal surges, like Black Friday, can cause cost overruns if not forecasted accurately.

- What-If models reduce forecast errors to under 7%, helping businesses align spending with goals.

For UK businesses, this approach ensures better financial planning, avoids budget surprises, and identifies savings opportunities in a rapidly changing cloud landscape.

What Is The Best Way To Forecast Cloud Costs?

Common Problems in Cloud Cost Forecasting

Understanding these frequent challenges in cloud cost forecasting highlights why flexible What-If models are so important.

Variable Workloads and Dynamic Pricing

Cloud forecasting is far more unpredictable than traditional IT budgeting, thanks to auto-scaling and fluctuating demand. Workloads can change by the hour due to seasonal spikes, product launches, or sudden traffic surges. For example, a global retailer saw their multi-cloud expenses jump by 42% year-over-year during Q4. This was largely due to development environments spiralling out of control and idle GPU clusters eating up 18% of their cloud budget[5].

Cloud providers like AWS, Azure, and Google Cloud charge for a range of services - compute hours, storage, network egress, and API requests - each with its own variable pricing. These dynamic pricing models are tricky to predict, especially when AI workloads or unexpected user activity trigger automatic scaling. This complexity, combined with the challenge of collecting and analysing data across multiple cloud platforms, makes accurate forecasting a daunting task.

Low Visibility Across Cloud Environments

Fragmented billing data is another major roadblock to accurate forecasting. With 78% of organisations now using multi-cloud or hybrid setups[4], billing data often comes in different formats from various providers and is managed by separate teams. Finance departments might still rely on manual spreadsheets, while engineering teams independently allocate resources.

Without real-time visibility, anomalies often go unnoticed until the invoice lands. Untracked workloads and unexplained expenses only add to the confusion. While 94% of organisations claim to monitor costs, only 34% have advanced cost management practices in place[4][6]. This gap between tracking and actual control creates a considerable challenge.

Budget Overruns and Poor Resource Allocation

The combination of unpredictable demand and unclear billing data often leads to budget overruns and inefficient resource use. Inaccurate forecasts result in wasted resources and last-minute cost-cutting measures. Overprovisioning and leaving resources idle are common issues, particularly for UK businesses, where operational efficiency takes a hit.

One global retailer faced such uncontrollable Q4 costs that they had to enforce a 25% budget freeze, jeopardising their ability to scale e-commerce operations during a critical trading season[5]. The lack of alignment between finance, engineering, and procurement teams means that early warning signs are frequently missed. In fact, 73% of organisations report increased operational complexity when trying to balance cost control with performance[3][4]. This often results in unexpected expenses, strained relationships between teams, and reactive decisions that can derail long-term cloud strategies.

What-If Models for Cloud Cost Forecasting

What Are What-If Models?

What-If models are tools for scenario analysis that help you predict potential future outcomes by simulating various scenarios. Instead of relying on static spreadsheets that merely extend last month's spending trends, these models integrate historical usage data with hypothetical changes - like scaling workloads, adjusting pricing commitments, or launching new services. For instance, they can answer questions such as, What would our AWS bill look like if Black Friday traffic doubled?

or How much could we save by moving 30% of our compute resources to reserved instances?

[2][4].

Modern What-If models go a step further by using AI and machine learning to analyse billing patterns, including traffic spikes, seasonal fluctuations, and growth rates. These tools can automatically create multiple budget scenarios, turning forecasting into a strategic process. Instead of guessing, you get insights into potential anomalies before they appear on your invoice [2][4].

How What-If Models Work

At their core, What-If models turn hypothetical scenarios into practical forecasts. The process begins with unified data pipelines that gather billing data from cloud providers like AWS, Azure, and GCP, converting different formats into a single, cohesive view [5]. The system then examines historical patterns - such as compute usage, storage expansion, and network activity - to establish a baseline for typical behaviour.

When a specific scenario is defined, the model adjusts critical parameters. For example, you might simulate reducing underutilised instances by 12% or estimate the cost impact of a 20% increase in shadow IT from untracked development environments. AI-powered projections account for factors like elasticity, pricing tiers, and commitment discounts to dynamically forecast costs [5]. These models achieve impressive accuracy, often with a Mean Absolute Percentage Error (MAPE) of under 7% [2][5], far outperforming manual spreadsheet-based methods. For UK businesses, this level of precision is a game-changer, enabling better preparation for seasonal demand and regional pricing shifts.

Use Cases for UK Businesses

For UK retailers, What-If models are invaluable for predicting seasonal demand surges during events like Black Friday or the Christmas shopping period. By forecasting costs tied to automated scaling and variable pricing, businesses can pre-arrange reserved capacity or secure commitment discounts, avoiding the 30–50% cost overruns that often accompany peak trading seasons [5]. This kind of proactive planning is crucial for managing expenses during critical periods when overspending can severely impact profitability.

For the 78% of organisations operating in multi-cloud or hybrid environments [4], What-If models offer a way to simulate data transfer costs, regional pricing differences, and resource distribution across providers. For example, running a 12-month simulation across AWS, Azure, and GCP, with a best-case scenario of 12% rightsizing, revealed potential savings of £3.1M. On the flip side, a worst-case scenario, factoring in 20% shadow IT growth, projected an 18% cost overrun [5]. These insights are particularly valuable for navigating the complexities of fragmented billing systems and testing scenarios like shifting AI workloads or switching regions for sustainability goals.

How to Implement What-If Models

Step 1: Gather and Examine Historical Data

Start by collecting 12–24 months of usage and billing data from each cloud provider. This should include key metrics like compute hours (vCPUs, GPUs), storage volumes (GB per tier), data transfer (GB by region), managed services usage, and any discounts, such as reserved instances or savings plans [2][5].

Tag each resource with details like its environment, application, business unit, and cost centre. This step makes it easier to trace spending back to its source and identify trends, such as seasonal spikes seen during November–December in UK retail [3][7]. Make sure to normalise the data into a consistent format - daily records with quantities, effective prices in pounds (£), and uniform tags. Using a centralised cost data pipeline or FinOps tool can help automate data collection, handle currency conversions to pounds, and standardise tagging across teams.

Unified monitoring tools can combine technical metrics, like CPU usage, memory, request rates, and autoscaling events, with cost data. This integration helps pinpoint which activities are driving expenses. Automated tagging enforcement ensures untagged resources don’t lead to untracked spending. Hokstad Consulting can assist UK businesses in creating a data architecture that merges DevOps monitoring with billing data, laying the groundwork for accurate forecasting.

Step 2: Define Scenarios for Simulation

Once your data is unified, the next step is to create specific simulation scenarios.

Base these scenarios on clear business drivers such as expected user growth, product launches, or market expansion [3][5]. Examples include modelling user growth, shifting workloads (e.g., moving from on-demand to reserved instances), migrating non-critical workloads to lower-cost regions (while staying compliant with UK and EU data residency rules), or optimising idle resources. Be explicit about assumptions like CPU utilisation, scaling rules, commitment levels, and performance thresholds.

For UK retailers, a useful scenario might involve preparing for Black Friday or Christmas peaks, where traffic could double or triple. This could test whether autoscaling with spot instances can handle demand within a specific cost limit. SaaS providers might simulate onboarding ten new enterprise clients each quarter to evaluate how multi-tenant versus single-tenant architectures impact compute and database costs over 12–18 months.

Prioritise scenarios based on their potential impact versus the effort required. For instance, modelling reserved instance adoption can reveal savings of 60–75% on eligible workloads, making it a high-priority exercise. Similarly, public sector organisations often simulate migrations from on-premise to public or hybrid cloud setups to meet tight annual budgets. Focus your What-If models on decisions that significantly affect cloud spending.

Step 3: Leverage AI and Machine Learning for Predictions

With your unified data and scenarios in place, you can now refine forecasts and anticipate anomalies using AI and machine learning.

AI can analyse historical data, identify patterns, and create baseline forecasts [2][5]. Time-series models like Prophet, ARIMA, or gradient boosting are useful for predicting future usage, while machine learning-based anomaly detection can flag unexpected cost spikes - for example, idle GPU clusters consuming 18% of your budget.

These models can also integrate with autoscaling policies to optimise capacity during peak periods or pause non-essential workloads during quieter times, cutting costs without sacrificing performance. Organisations have reported savings of up to 30% by using AI-driven predictive optimisation instead of static rules. Before deploying machine learning, ensure your raw billing records are cleaned and aggregated into consistent time buckets (e.g., hourly or daily) and merged with relevant operational metrics.

To improve model accuracy, consider feature engineering. Include factors like lagged usage values, moving averages, calendar effects (e.g., month-end or UK bank holidays), and elements tied to promotions or product launches. Adding cost-related features - such as effective unit prices, reserved instance coverage, and the ratio of idle to utilised resources - can help distinguish real demand growth from inefficiencies. Hokstad Consulting can support teams in embedding these models into CI/CD pipelines and operational workflows, making cost-aware decisions integral to automated deployments and scaling.

Step 4: Schedule Regular Reviews

Once your simulations and predictive models are in place, set up regular reviews to keep forecasts aligned with actual spending.

Maintain a rolling 12–18 month forecast, updated monthly, with a more detailed three-to-six-month view that aligns with product and sales plans [2][5]. Hold monthly FinOps or cloud governance meetings to review variances between forecasts and actual spending, especially when deviations exceed 5%. These meetings are a chance to adjust growth assumptions, update discount coverage, and refine What-If scenarios as needed.

Review major financial commitments quarterly to check if usage patterns have shifted enough to justify changes. Over time, re-run scenarios to account for new factors, such as changes in UK data protection regulations, the addition of new regions, or fluctuations in exchange rates affecting costs in pounds (£). This regular review process turns What-If modelling into a continuous strategic activity.

Strong governance is essential. Tie the outputs of What-If models directly to budgets, KPIs, and engineering backlogs. Many organisations establish cross-functional FinOps councils - bringing together finance, engineering, product, and procurement teams - that meet regularly to review forecasts, scenario outcomes, and cost-performance trade-offs. Self-service dashboards can also empower engineering teams to explore how changes, like scaling a service or switching instance types, could impact their monthly budgets in pounds (£).

Need help optimizing your cloud costs?

Get expert advice on how to reduce your cloud expenses without sacrificing performance.

Benefits of What-If Models for Cloud Cost Forecasting

::: @figure  {Standard Cloud Forecasting vs What-If Models: Accuracy and Cost Savings Comparison}

:::

{Standard Cloud Forecasting vs What-If Models: Accuracy and Cost Savings Comparison}

:::

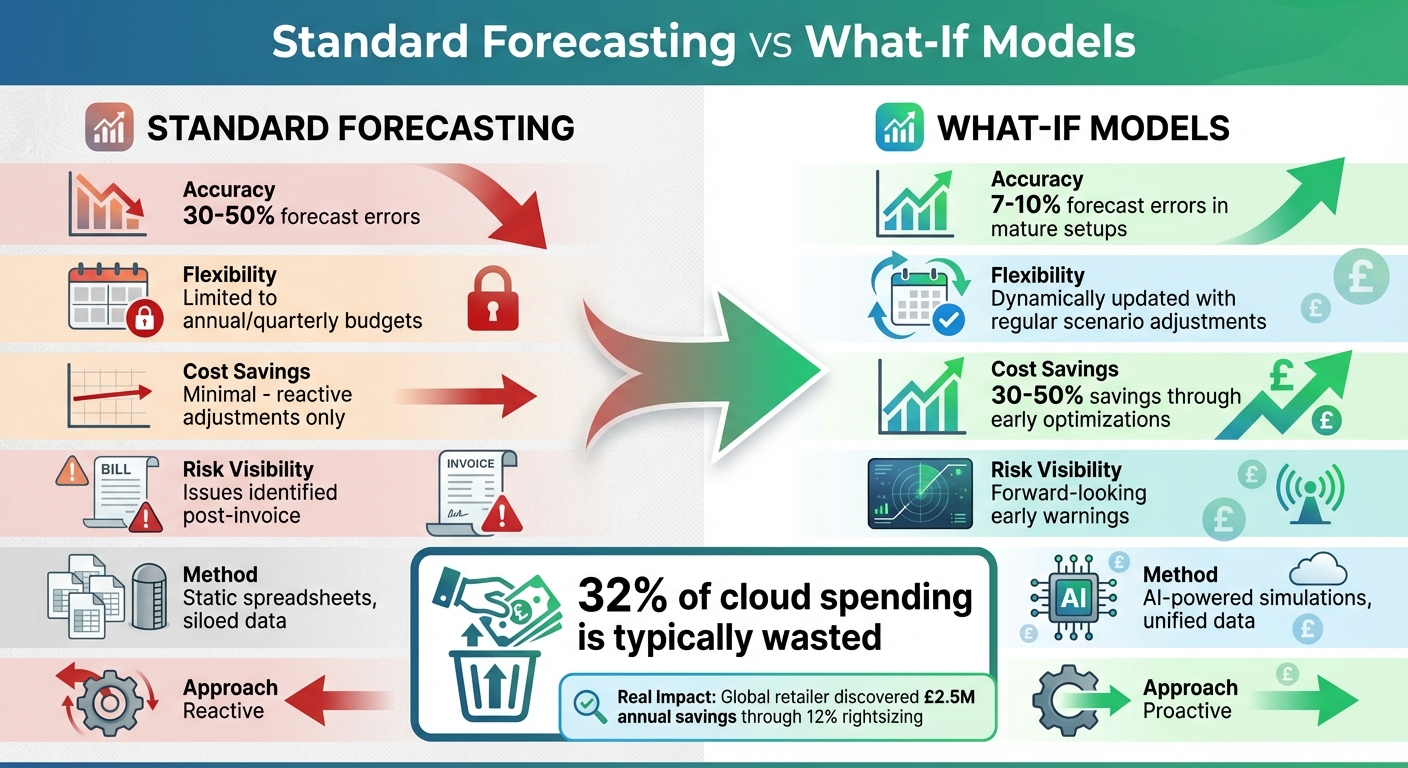

Comparison: Standard Forecasting vs. What-If Models

Traditional cloud forecasting often relies on static assumptions and basic trend analysis, which struggle to account for sudden usage spikes or unexpected pricing changes. On the other hand, What-If models simulate multiple future scenarios by factoring in variables like user growth, new workloads, and pricing tier adjustments. This dynamic approach significantly improves forecasting accuracy, reducing errors from a typical 30–50% to less than 7% within a few quarters [2][5].

Many organisations still rely on spreadsheets, pulling siloed data from various cloud providers. This approach makes it difficult to detect real-time anomalies such as idle GPU clusters or unexpected data transfer fees [5]. These traditional methods tend to be reactive - forecasts are adjusted only after a shocking bill arrives, rather than proactively exploring potential demand and pricing scenarios beforehand [2][5].

For example, a global retailer using multi-scenario simulations discovered that a 12% rightsizing initiative could save them approximately £2.5m annually. At the same time, they identified an 18% potential cost overrun caused by shadow IT [5].

| Feature | Standard Forecasting | What-If Models |

|---|---|---|

| Accuracy | Low, with 30–50% forecast errors [5] | High, with errors reduced to 7–10% in mature setups [5] |

| Flexibility | Limited to annual or quarterly budgets [2][3] | Dynamically updated with regular scenario adjustments [2][5] |

| Cost Savings | Minimal, as adjustments are reactive [5] | 30–50% savings through early optimisations and anomaly detection [5][4] |

| Risk Visibility | Issues identified post-invoice [3][4] | Forward-looking, offering early warnings of overruns [2][5] |

These differences make it clear why What-If models are particularly valuable for UK businesses, where local financial and seasonal demands require more tailored forecasting approaches.

Benefits for UK Businesses

What-If models address the limitations of traditional forecasting by giving UK organisations a proactive way to manage budgets. With these models, teams can simulate various budget scenarios in £, ensuring their resource usage aligns with service levels and project timelines [2][5]. They’re especially helpful for planning around UK-specific seasonal trends, such as retail surges during Black Friday, Christmas, or financial year-end cycles. Simulating these demand spikes helps predict their impact on monthly and quarterly costs [2][5].

Research shows that 32% of cloud spending is typically wasted [3][4]. By testing utilisation targets, scaling thresholds, and purchase models, scenario planning can significantly reduce this waste [2][5]. UK businesses can also use What-If analysis to evaluate trade-offs between resilience (e.g., multi-region redundancy) and cost, aligning their resource use with risk tolerance and regulatory demands [3][4]. These models even allow organisations to simulate workload shifts between providers or regions, integrate new technologies like AI/ML platforms, or scale applications for both UK and EU customers - while assessing cost and performance impacts in advance [5][4].

For finance teams, What-If models provide early warnings of potential cost overruns, enabling more predictable cash flow management and smoother alignment with corporate budgets [2][5]. They also help UK organisations prepare for fluctuations in exchange rates and regional price differences, especially when managing workloads across European or global regions while adhering to a GBP-based budget.

Overcoming Challenges with Hokstad Consulting

Tackling Integration and Model Accuracy Problems

What-If models often stumble due to fragmented data and inconsistent cost allocation. Hokstad Consulting addresses these challenges head-on by starting with a detailed discovery and audit phase. This involves mapping out existing cloud accounts, workloads, and environments - whether they're on public, private, or managed hosting platforms [4][8].

Once the groundwork is laid, Hokstad conducts targeted audits to refine data integration. They focus on three key areas:

- Cost and usage audit: Identifies waste and anomalies in spending.

- Tagging and attribution audit: Links significant workloads to specific cost centres.

- Architecture and performance audit: Examines how scaling rules influence cost patterns.

These audits provide essential data points - like baseline usage, seasonal trends, and growth rates - making budget forecasts for quarterly and annual planning in GBP more reliable for finance teams and leadership [4][7].

Hokstad also brings in AI and machine learning to analyse historical usage data. This helps uncover patterns, such as seasonal fluctuations or spikes caused by campaigns, and ensures model assumptions are automatically updated [2][4]. Automated pipelines handle data ingestion, refresh scenarios (like new instance types or discount programmes), and deliver updated insights to engineering and finance teams. This automation reduces forecast inaccuracies and ensures What-If models stay relevant as workloads and pricing evolve.

Leveraging Hokstad's Expertise for Cost Management

Hokstad's cloud cost engineering service uses What-If insights to align workload behaviours with the most efficient pricing models. These include options like reserved instances, savings plans, or spot usage. By modelling different architectural scenarios - such as serverless versus container-based setups or exploring storage tiering - teams can see the financial impact over time. For example, UK organisations can ask, What happens to our annual spend in GBP if we shift 40% of traffic to spot instances?

and get clear, data-driven answers before making major changes [2][4].

Their DevOps and automation expertise further integrates What-If modelling into CI/CD pipelines and infrastructure-as-code templates [4]. When services are deployed or scaled, parameters like traffic, replicas, storage, and regions are automatically updated. For organisations with hybrid or multi-cloud strategies, Hokstad creates scenarios that weigh the pros and cons of single-cloud versus multi-cloud setups. These include factors like regional pricing differences, inter-region data transfer costs, and resilience requirements [4].

To keep everything on track, Hokstad establishes a FinOps-style review process. Forecasts are revisited monthly or quarterly by cross-functional teams, using KPIs such as forecast accuracy and cost centre variances to fine-tune model assumptions [4][9].

Conclusion

For UK businesses, getting cloud cost forecasting right isn’t just a good idea - it’s a necessity. With more than 85% of organisations embracing cloud-first strategies and many wasting resources due to inefficient allocation, relying on outdated, static annual budgets simply doesn’t cut it anymore [3][6]. This is where What-If models step in, offering a smarter way to plan for variable workloads, shifting pricing, and unpredictable growth.

These models don’t just address the challenges - they deliver real results. By cutting forecast errors from over 25% to less than 10%, they enable businesses to make proactive adjustments, saving anywhere from 15% to 30% through improved visibility and control [3][6]. This aligns seamlessly with FinOps principles, helping organisations tie costs to business outcomes while spotting anomalies before they become costly mistakes.

To make the most of What-If models, businesses should focus on integrating historical data, crafting realistic scenarios, and leveraging AI-powered predictions. Regular review cycles ensure these forecasts remain accurate and actionable. For UK organisations managing budgets in pounds sterling, juggling the complexities of multi-cloud environments, and meeting strict regulatory standards, this approach offers the precision needed to safeguard margins while driving innovation.

Hokstad Consulting brings the expertise to make this happen. Specialists in cloud cost engineering, DevOps transformation, and AI strategy, they help UK businesses overcome integration hurdles, fine-tune model accuracy through detailed audits, and instil cost-conscious practices within teams. Their track record speaks for itself - clients have saved £120,000 annually and reduced costs by 30%, all while boosting performance [1].

If your business is ready to take control of cloud spending with accurate scenario forecasting, find out how Hokstad Consulting can help at hokstadconsulting.com.

FAQs

How can What-If models improve the accuracy of cloud cost forecasts?

What-If models improve cloud cost forecasting by enabling organisations to simulate a range of scenarios. These simulations consider factors like resource usage, configurations, and allocation strategies, helping to pinpoint more cost-effective solutions, predict potential overspending, and support smarter decision-making.

By exploring different possibilities, businesses can fine-tune their cloud strategies to meet both budgetary targets and operational demands, resulting in forecasts that are not only more precise but also more practical.

What challenges in cloud cost forecasting can What-If models help solve?

Cloud cost forecasting can be tricky, with challenges like unexpected charges from underused resources, navigating the complexity of cloud setups, and spotting opportunities to reduce expenses.

What-If models offer a practical solution by enabling organisations to simulate various scenarios. These models predict how adjustments in configurations or usage patterns might affect costs. This approach empowers businesses to make smarter decisions, manage their budgets more effectively, and refine their cost predictions.

How do What-If models help UK businesses manage cloud costs effectively?

What-If models give UK businesses a powerful way to predict cloud expenses with greater precision. By simulating various scenarios, these models help identify areas where costs can be trimmed and resources better allocated. This not only helps avoid unnecessary spending but also aids in making informed decisions, like adjusting resource sizes or exploring hybrid cloud solutions.

With What-If models, companies can achieve substantial savings on cloud costs - sometimes slashing expenses by up to 50% - all while maintaining performance and efficiency. This forward-thinking method enables organisations to align their cloud strategies with both their operational requirements and financial objectives.